How much do you have in

outstanding invoices?

Current total value of your accounts receivable

How much would you like to draw

down each month?

Average monthly funding amount

What is your average payment term?

How long your customers take to pay

Your Estimated Drawdown and Cost

Here’s what each invoice drawdown could look like

Invoice Value

Transaction fee

Drawdown amount

Discount fee

No other fee

How much would you like to draw

down each month?

Average monthly funding amount

What is your average payment term?

How long your customers take to pay

Your Estimated Drawdown and Cost

Here’s what each invoice drawdown could look like

Invoice Value

Transaction fee

Drawdown amount

Discount fee

No other fee

Schedule a free meeting to find out more

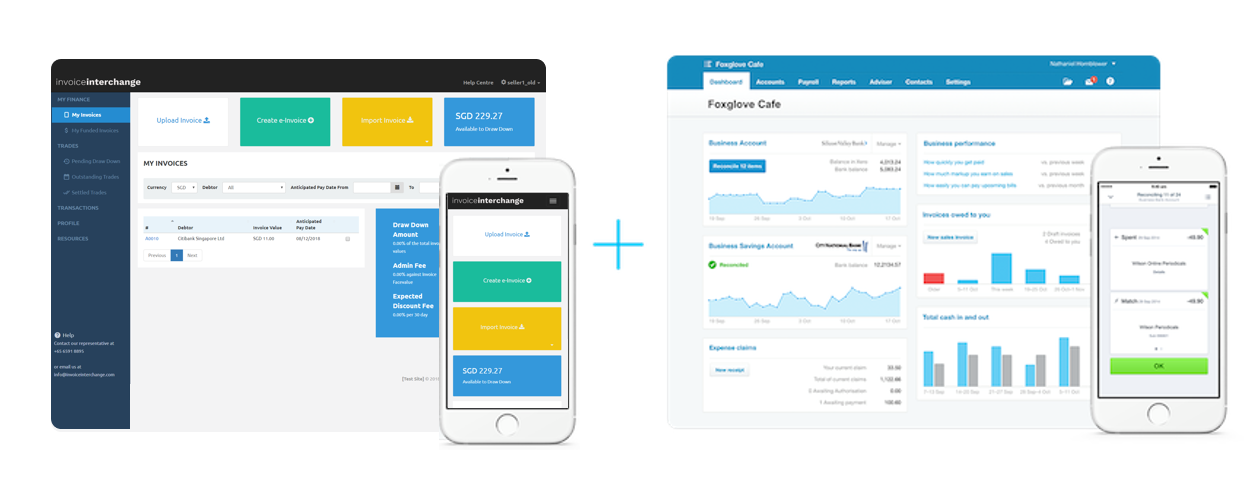

integration

integration