Singapore: Increase in Write-offs Across B2B Invoices

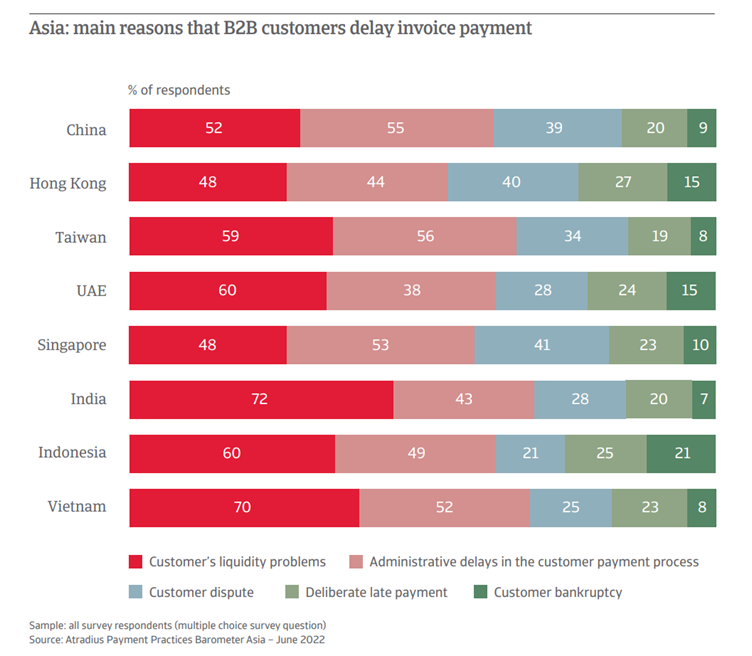

Atradius released its latest annual Business-to-Business (B2B) Payment Practices Barometer in June 2022. The report provides information based on surveys conducted across businesses in Singapore and Asia. This year in Singapore, the report found a 50% increase in debts written off (uncollectable invoices) representing 9% of overall B2B invoices in the Singapore market. The reasons for defaults were liquidity problems, customer disputes, administrative inefficiencies and disputes. Businesses are now spending more time and resources chasing unpaid invoices.

B2B credit sales

53% of Singapore businesses (a slight decrease from 2021 at 59%) are continuing to cautiously offer credit term to their existing customers to remain competitive despite the increase in default rates. However, trade credit granted to new customers reduced, citing higher risk of default, insufficient in-depth risk information on customers, or unsustainable credit management cost.

Reduction in payment terms

Due to the perception of higher default risk, average payment terms offered to customers have declined from 37 days in 2021 to 33 days in 2022. However, on the contrary, many businesses reported that they are offering longer payment terms to their customers in order to win sales.

Bad debt trending upwards

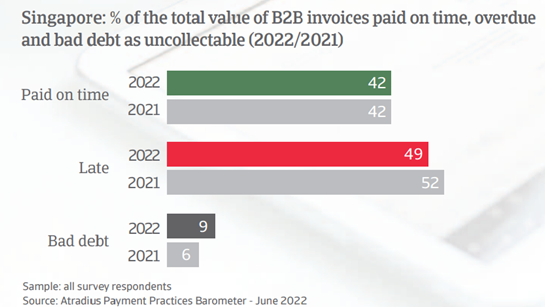

Average late payment days amongst Singapore businesses has decreased from 52% in 2021 to 49% 2022. This is consistent with the drop in B2B credit sales. On average, overdue invoices are collected about 20 days after its due date.

Bad debt on the other hand saw a significant increase of 50% from 6% of the total value of B2B invoices to 9% in 2022. This is a sign of financial distress amongst businesses. 53% of businesses reported that they have deployed additional time and resources to manage overdue B2B invoices. Many companies, especially in the construction industry started to offer early payment discounts to their customers to reduce possible bad debts.

Impact of payment defaults

Below are some of the impacts faced by Singapore businesses because of higher payment defaults.

Additional administrative tasks

Almost half of businesses polled have carried out more regular checks on customer credit quality and trend, as well as avoiding credit risk concentration on a single customer or groups of customers with the same feature.

Increase in cash on delivery

Singapore companies across industries are now requesting for cash payments from their B2B customers upon delivery of goods and services to minimise bad debt.

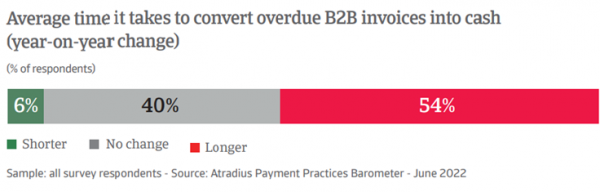

Increase in Day Sales Outstanding (DSO)

More than half of businesses experienced longer DSO, which means it takes longer to convert invoices into cash. This results in deterioration of business liquidity.

Mitigation

Many industries are now sourcing for external collection agencies to help collect unpaid invoices. Trade credit insurance also has been used as a tool to minimise bad debts.

Singapore business outlook

Despite the struggling economy caused by the pandemic, businesses are generally optimistic about the outlook for the coming months. Majority of surveyed business anticipate an increase in credit sales to grow market share, as well as an improvement in payment practices.

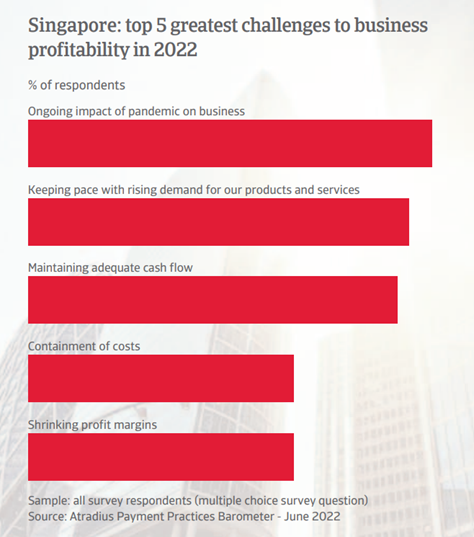

The main ongoing concern amongst businesses are:

- How an ongoing pandemic may have an impact on their businesses.

- Keeping pace with rising demand of products and services as the economy is rebounding from the pandemic.

- Ability to manage sufficient cashflow to keep business afloat.

- Containment of costs.

- Decreasing profit margin due to rising costs.

Related Articles

Singapore Businesses Remain Positive Outlook for 2024

Unveiling the Atradius Payment Barometer 2023: Downbeat Exports Outlook Poses Challenge for B2B Trading on Credit