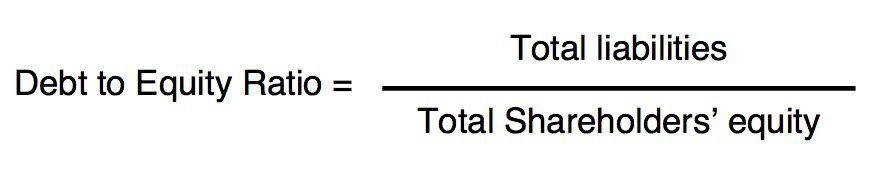

The debt to equity ratio, also known as risk or gearing ratio, is a solvency ratio that shows the relation between the portion of assets financed by creditors and shareholders. Using figures obtained through financial statements, the ratio is used to evaluate a company’s financial leverage i.e. the percentage of financing that comes from creditors and investors.

We can calculate the ratio by dividing total liabilities by total stockholder’s equity.

Interpreting Debt to Equity Ratio

For example, a debt to equity ratio of 1.5 means a company uses $1.50 in debt for every $1 of equity i.e. debt level is 150% of equity. A ratio of 1 means that investors and creditors equally contribute to the assets of the business.

When using the ratio it is very important to consider the industry within which the company exists. Because different industries have different risk ratio benchmarks; some industries tend to use more debt financing than others. As a rule of thumb, a ratio that is greater than the industry average is considered high and risky.

A higher ratio indicates that there is more usage of creditor financing i.e. bank loans than shareholders’ financing. Lack of performance could be one reason why a company is seeking out aggressive debt financing, to obtain enough cash to fulfil its debt obligations. Therefore, companies with high debt-to-equity ratio risk faces reduced ownership value, increased default risk, trouble obtaining additional financing and violating debt covenants.

A more financially stable company usually has lower risk ratio. However, low ratio may not always be a good thing. It could also indicate that the company is not taking advantage of the increased profits that financial leverage may bring.

Limitations of Debt to Equity Ratio

1. Ambiguity in calculation of debt

The terms “debts” and “liabilities” often get thrown around as if they mean same thing. In fact, they do not. All debts are liabilities, but not all liabilities are debts. Debts in short are money that has been borrowed and must be repaid; whereas a liability is defined as a company’s obligations that arise during business operations.

Due to the ambiguity in understanding the two terms, the balance sheet categories may contain individual accounts that would not normally be considered “debt” or “equity” in the book value of an asset.

Examples of Debts

- Drawn line-of-credit

- Notes payable

- Current portion of long-term debt

- Bonds payable

- Long-term debt

- Capital lease obligations

Examples of non-debts

- Accounts payable

- Accrued expenses

- Deferred revenues

- Dividends payable

Inconsistency

Preferred stock is sometimes considered equity, but the preferred dividend, par value, and liquidation rights makes it look more like debt. Including preferred stock in total debt will increase the debt to equity ratio; thus making a company unappealing to investors and creditors due to the higher risk they possess.

On the other hand, including preferred stock in the shareholder equity portion of the ratio will increase the denominator and lower the ratio; creating a seemingly less risky prospect.

Conclusion

Investors can make use of debt to equity ratio to identify companies that are highly leveraged and of higher financial risk. It can be compared against industry averages and other similar companies to gain a general indication of its equity-liability relationship.

Related Articles

Boosting Your Business: Top Strategies for Improving Cash Flow

The Ultimate Guide to Receivables Financing: Boosting Your Business Cash Flow