Unlock instant

working capital with

invoice financing

A cash flow solution that helps you get paid upfront

on your outstanding invoices to bridge cash flow gaps.

Unlock flexible

funding with

invoice finance

A cash flow solution that helps you get paid upfront

on your outstanding invoices anywhere and anytime.

Get paid sooner on the funds owed to you in outstanding invoices

InvoiceInterchange helps you take control of cash flow. With our simple straightforward invoice finance solution, you decide which invoices to fund and when to fund, with no need to commit your whole sales ledger. Whether your needs are one-off, seasonal, or ongoing, you can choose the term that works best for your business.

InvoiceInterchange specialises in invoice financing.

We are committed to bolstering local businesses who are the backbone of the economy. Our invoice finance products are tailored to meet your cash flow requirements as a growing business, with its flexibility, speed, and ease of access.

Selective invoice

finance

You decide which invoices to fund

Pay as you use

Your customers repay your balance

Contract

finance

Bring forward cash against future recurring revenue from

on-going contracts, licenses or retainers for up to 6 months.

Whole ledger

finance

Draw down funds against all your outstanding invoices

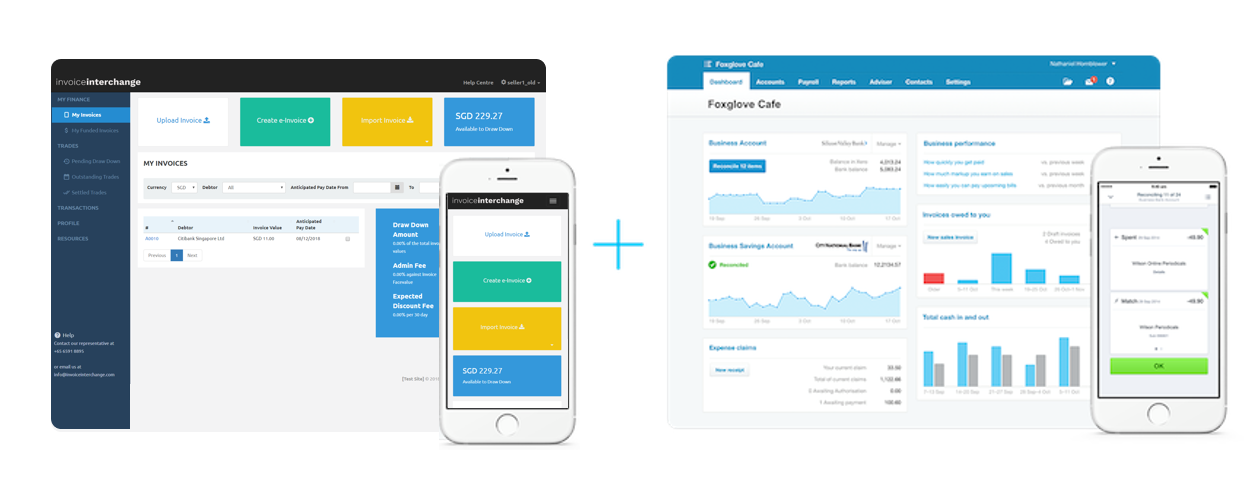

Option to connect your Xero account

Flexible

Flexible

You select the invoices to fund when you need it, with no locked-in contracts or minimum fees. This provides your business with the essential tool to effectively manage and streamline cash flow.

Grows with you

Grows with you

As your business grows, your facility size will also increase to support your ever-changing cashflow needs.

Quick cash injection

Quick cash injection

Submit drawdown requests with a few clicks of a button via our purpose-built invoice finance platform. Funds in your business account in as little as 4 hours.

Personalised service

Personalised service

Invest in your growth

By turning unpaid invoices into immediate working capital, you are now in charge.

-

- Meet your overhead and payroll commitments

- Cover upfront costs

- Pay off unexpected expenses

- No more waiting 30, 60, or 90 days to get paid

- Flexible access to working capital for growth

- Delayed payments will no longer hold you back

integration

integration

This means a faster decision process and account setup. All eligible invoices will be available on the platform – simply select the invoices you wish to draw down on and funds will be transferred to your account.* Xero postings of invoices financed are also automated making it all a seamless experience.

*Upon successful invoice validation

What our customers are saying

-

Jim Perkins

COO of Allies Group Pte LtdWhat we saw in InvoiceInterchange was an alternative finance provider with a service proposition geared towards start-ups and staff that really understand the unique needs of new companies,

Frequently asked questions

We offer invoice financing to businesses incorporated in Singapore or Australia that have one or more creditworthy customers. You sell to your customers on payment terms who pay 30, 60, or 90 days later. Any delayed payments from your customer base on these unpaid invoices can cause short-term liquidity challenges.

The key differences between invoice financing and traditional business loans are:

(1) invoice financing converts your current assets (accounts receivable or unpaid invoices) into immediate cash. Whereas, a traditional business loan adds more debt to your business.

(2) Invoice financing offers you continuous access to funds by getting a cash advance on unpaid invoices before their due date. A traditional bank loan only gives you a one-time lump sum.

(3) Invoice financing is a flexible form of short-term financing that gives you quick access to working capital to support ongoing operational expenses. On the contrary, a traditional bank loan would be more suitable for a business looking for a relatively significant amount of money to invest in things like machinery, renovations, overseas expansion, R&D, and property purchases.

Let’s start with what’s common, they all give you money for unpaid invoices and the advance is based on your invoice value. Invoice financing is a form of short-term financing that gives you an advance on what your customers already owe you and can also be referred to as sales invoice financing. You pay interest on your advance.

Invoice factoring is a financing arrangement where the factoring company buys your unpaid invoice and in turn, collects payment from your customers. This is also commonly known as invoice discounting. Invoice factoring may not pay you a high percentage of your invoice but this can be negotiated with the factoring company.

Receivables financing is where your invoices act as a credit line and how much funding you have access to goes up and down according to how much your customers owe you at any point in time. At InvoiceInterchange, we are an invoice financing provider that gives you immediate cash flow to fuel your business growth.

We only have 2 fees, a transaction fee, and an interest (discount) fee. It is straightforward and transparent with no hidden fees. Easy, simple invoice financing for business owners.

We can give funds for invoices with payment terms between 7 to 120 days.

We fund invoices with a minimum value of SGD 10,000 up to SGD 1 million. Read more on how invoice financing works here.

If you are unable to find your answer here, please contact us.

We would be happy to discuss any queries with you.

While you are here

The Benefits of Invoice Financing: Boost Your Business Cash Flow

Unlocking Cash Flow: Invoice Financing for Small Businesses